By automating their most repetitive, time-consuming tasks, your accounting teams can improve accuracy, save time, and focus more of their brainpower on strategic decision-making, which helps your organization achieve greater efficiency and productivity.

But how do you automate accounting processes effectively without knowing where to begin? It starts with understanding what accounting process automation involves, its benefits, the challenges of manual accounting, and the key tasks that can — and should — be automated.

Whether you’re the sole accountant at a small business or part of a larger finance team, these insights will give you the knowledge you need to transform your accounting workflows.

First things first: Let’s define accounting process automation

Accounting process automation involves using technology to streamline and enhance financial operations within an organization. This includes automating repetitive tasks such as invoicing, expense management, and financial reporting, which increases efficiency and reduces the likelihood of human error.

Key components of accounting process automation include software applications that integrate with existing financial systems, workflow management tools, and data analytics capabilities that provide insights into financial performance.

The right technology plays a crucial role in automating accounting tasks. With cloud-based solutions and advanced software tools, businesses can manage their financial processes in real-time, improving accessibility and collaboration among teams. Automation technologies, such as robotic process automation (RPA), handle routine tasks like data entry, freeing up accounting professionals to focus on strategic decision-making and value-added activities.

Benefits of accounting process automation

Automating accounting processes offers numerous benefits that can significantly transform business operations. One of the most compelling advantages is cost savings and efficiency improvements. By streamlining repetitive tasks like data entry and invoice processing, organizations can reduce the time spent on manual labor, allowing staff to focus on higher-value activities. This not only decreases operational costs but also enhances overall productivity.

Another critical benefit is the reduction in human error and enhanced accuracy. Manual accounting processes are prone to mistakes, leading to financial discrepancies and compliance issues. Automation helps eliminate the risk of human error, ensuring that data is entered and calculated correctly. This accuracy improves the integrity of financial reports and fosters trust among stakeholders.

Improved compliance and reporting capabilities are also vital for maintaining regulatory standards. Automated accounting systems can generate real-time reports, ensuring that all financial data adheres to legal requirements. This level of transparency and accountability aids in audits and positions the organization as a trustworthy entity in the eyes of clients and regulators alike. Clearly, automating accounting processes is a strategic move for any forward-thinking business.

Despite its many benefits, a few myths still surround accounting process automation. A common misconception is that automation will replace human jobs. In reality, automation augments human capabilities, so professionals can engage in more meaningful work that requires critical thinking and creativity. Another myth is that implementing automation is overly complicated and costly; however, many solutions are user-friendly and scalable, making them accessible for businesses of all sizes.

Challenges of manual accounting

Manual accounting processes present several challenges that can hinder efficiency and accuracy. One common issue is the increased likelihood of human error. Simple mistakes, such as data entry errors or miscalculations, can lead to significant discrepancies in financial statements, affecting decision-making and financial reporting.

Manual accounting is also time-consuming. Teams spend countless hours on repetitive tasks like ledger maintenance, invoice processing, and reconciliation. This not only detracts from their ability to focus on strategic initiatives but also delays the overall financial reporting process, hindering timely decision-making.

The impact of errors in manual accounting on business operations can be profound. Inaccurate financial records can lead to poor budgeting decisions, cash flow issues, and compliance risks. Businesses may face audits or penalties due to discrepancies that could have been easily avoided with automated processes. Automation mitigates these risks and enhances overall productivity, allowing finance teams to shift their focus from mundane tasks to more value-added activities.

Accounting process problems and automation solutions

| Problems | Solutions |

|---|---|

| Manual data entry errors | Automated data capture |

| Delayed invoice processing | Faster processing with automation |

| High administrative costs | Reduced need for manual intervention |

| Difficulty in tracking payments | Real-time payment tracking |

Key accounting tasks to automate

Automating accounting processes is essential for efficiency and accuracy in today’s business environment. Key tasks to consider automating include invoicing and accounts receivable management. Automated invoicing systems streamline billing processes, reduce errors, and enhance cash flow management. Automated reminders ensure timely payments, improving overall financial health.

Expense tracking and accounts payable processes are also critical areas for automation. Automating these tasks allows for real-time tracking of expenses, ensuring that financial data is accurately captured and categorized. This simplifies the approval workflow for expenses and aids in maintaining compliance and controlling costs. Automated solutions significantly reduce the administrative burden on finance teams, allowing them to focus on more strategic initiatives.

Financial reporting and analysis can also benefit from automation. Automated reporting tools generate detailed financial reports quickly and accurately, saving time and providing valuable insights into financial performance. With real-time data, finance professionals can make informed decisions and identify trends that drive organizational growth.

5 steps to automating your accounting processes

By now, you’ve seen how automating accounting processes can significantly enhance efficiency and accuracy.

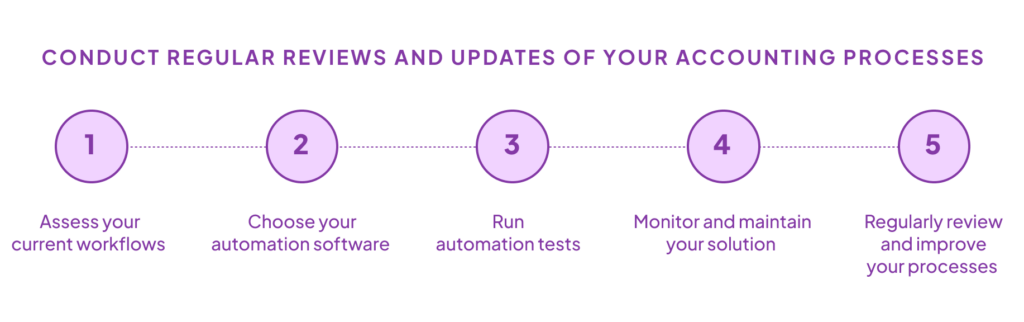

But where’s the best place to get started? We’ve identified five steps to set you on the path toward successful accounting process automation:

- Assess current accounting workflows. Take a comprehensive look at how tasks are currently performed, identifying bottlenecks, redundancies, and areas prone to errors. Documenting these workflows will provide a clear picture of where automation can have the most impact.

- Select the right accounting automation software. Look for solutions that align with your business needs. Consider factors such as integration capabilities, user-friendliness, and scalability. Platforms that offer tailored solutions can seamlessly integrate with existing systems, enabling you to automate repetitive tasks like invoicing, expense tracking, and financial reporting.

- Implement and test automated solutions. Begin by setting up the automation features within the selected software. Conduct thorough testing to ensure that all automated processes work as intended, and adjust settings as necessary. Gathering feedback from your accounting team during this phase can help identify any additional tweaks. By following these steps, you can create a more streamlined and efficient accounting process that allows your team to focus on strategic initiatives rather than manual tasks.

- Perform continuous monitoring and maintenance. Regularly check for discrepancies or errors and ensure that the automation software is functioning optimally. This proactive approach helps to address any issues before they escalate, providing a seamless experience for users and maintaining the integrity of your accounting data.

- Conduct regular reviews and updates of your accounting processes. As your business evolves, so should your automation strategies. Assess your workflows periodically to identify areas for improvement or new automation opportunities. This iterative process enhances efficiency and ensures that your accounting practices remain compliant and aligned with industry standards.

Successfully automating accounting processes requires more than just implementing the right technology; it involves a holistic approach that includes effective staff training and effective change management. Begin by educating your team on the new automated systems, ensuring they understand how to use these tools to enhance their productivity. Involve them in the transition process to foster a sense of ownership and reduce resistance to change.

Accounting process FAQ

What are the first steps to automate accounting processes?

The first steps to automating your accounting processes are assessing your current workflows, selecting the right software that fits your needs, and implementing and testing the chosen solutions.

Is accounting process automation expensive?

While initial costs may be a consideration, many solutions are scalable and offer significant long-term savings by reducing manual labor and improving efficiency. Implemented correctly, automation will return value in the long run.

Will automation replace accounting jobs?

No. Automation is designed to augment human capabilities, enabling professionals to focus on strategic tasks rather than rote, time-consuming ones.

Learn more about how to automate your accounting processes with Nintex.