As CFO, you know that businesses can’t just invest in new technologies for the thrill of it. No matter how exciting AI seems, it’s only valuable if and when it makes your business money.

And unfortunately, that isn’t really happening yet. MIT found that despite organizations pouring an estimated $30-40 billion into AI initiatives, 95% of those companies are seeing zero return on their investment.

That means you’re caught between a rock and a hard place. You know AI could be transformative, but you can’t justify continued investment in technology that isn’t moving the needle on the metrics that matter.

So, what separates the AI initiatives that deliver from those that don’t? Our survey of 700+ CFOs and CIOs reveals a critical factor: A foundation of process automation.

The ROI gap is real … and expensive

Our research uncovered something fascinating: That jarring statistic from MIT doesn’t necessarily hold true for organizations that have built a foundation of automation before implementing AI. In fact, 95% of CFOs and CIOs surveyed report that their combined automation and AI initiatives are effectively delivering on business outcomes.

The same technology producing zero results for most organizations is generating significant value for those who do it right. And the difference comes down to one factor: Starting with automation.

When we asked finance leaders directly, 84% agreed that automation is a necessary first step before successfully implementing AI in business processes. Here’s why.

Why automation is the prerequisite for AI ROI

One CFO who adopted generative AI tools in 2024 reported significant efficiency gains, noting that a custom workflow automating vendor identification for journal entries reduced a process from 20 hours during month-end close to just 2 hours each month.

But efficiency gains like this don’t happen by implementing AI alone. They happen when AI is layered on top of automated processes that are already standardized, measurable, and optimized.

Here’s what automation does that AI can’t do on its own:

Creates clean data pipelines: AI models are only as good as the data they’re trained on. Without automation standardizing how data flows through your systems, AI ends up learning from inconsistent, error-prone inputs. Nearly half (47%) of survey respondents cite automation’s role in providing the clean data foundation that AI needs to operate successfully.

Establishes measurable baselines: How do you calculate ROI on AI if you don’t know what your processes cost before AI? Automation creates the performance metrics and benchmarks that make it possible to demonstrate value. In fact, 45% of CFOs say it’s easier to measure the value of AI when built on automated baselines.

Provides governance and control: This is critical for finance leaders. Automation embeds compliance requirements directly into workflows, creates automatic audit trails, and establishes the kind of financial controls that keep you out of regulatory trouble. And with 85% of leaders citing data quality as their most significant challenge in AI strategies, having automation handle data governance becomes non-negotiable.

Enables scalability: Fully automated AP teams have nearly doubled in two years, reaching 20%, with another 41% planning to automate their payables within the next 12 months. This automation maturity is what allows organizations to scale AI initiatives beyond one-off pilots.

In our survey, organizations at advanced stages of automation maturity (58% of respondents) saw tangible value from AI investments. Meanwhile, those still in early automation phases (42%) struggled to get AI beyond moderate productivity gains.

The finance function is the perfect proving ground

Finance operations are uniquely positioned to demonstrate the combined value of automation and AI. Why? Because finance deals with high-volume, rules-based processes that are perfect candidates for automation.

Consider accounts payable and receivable. AP and AR automation streamlines invoice processing, payment approvals, and collections, reducing manual errors and cycle times while ensuring real-time visibility into cash flow and financial health.

Then, when you add AI to automated AP/AR workflows, you unlock strategic capabilities like:

- Predictive cash flow forecasting that helps you optimize working capital

- Intelligent collections that know when and how to follow up with customers

- Automated fraud detection that catches duplicate or suspicious invoices

- Dynamic discounting decisions that maximize early payment benefits

Where our survey data gets interesting

When we asked CFOs and CIOs about their top priorities for AI implementation, 56% cited improving quality and accuracy as their primary goal. That’s ahead of productivity gains (56%), innovation (52%), and even cost reduction (39%).

This is a crucial insight when it comes to how we think about ROI. While individual productivity from AI might be easy to achieve, the strategic outcomes that leaders care about — quality, innovation, and decision-making — require the systematic consistency that only automation can provide.

Plus, 40% of leaders surveyed cite consistent compliance and governance as one of the primary reasons for relying on process automation technology. And 41% of CFOs report improved governance and risk management as a top outcome when combining AI with automation.

That means automation doesn’t just make AI more effective. It makes AI safer, more compliant, and more audit-ready — exactly what CFOs need to justify continued investment.

The consolidation imperative

Recent research shows that 61% of CFOs say AI agents are changing how they evaluate ROI, moving beyond traditional metrics to encompass a wider range of business outcomes including cost savings, risk and compliance improvements, and revenue growth.

This shift toward broader outcome measurement coincides with another trend: Consolidation. Our survey found that 64% of CFOs and CIOs intend to embed or consolidate AI into their automation strategy rather than maintaining separate platforms.

This makes perfect sense from a finance perspective. Every separate system adds cost, complexity, and integration risk. When you’re dealing with 100-300 SaaS tools in your tech stack (as 51% of mid-market organizations report), the last thing you need is yet another disconnected AI tool that requires its own maintenance, governance, and budget justification.

Unified platforms that bring automation and AI together solve multiple problems at once:

- They reduce vendor sprawl and licensing costs

- They simplify governance by having one place to manage permissions and compliance

- They provide end-to-end visibility across processes

- They make it easier to demonstrate ROI because you’re not constantly trying to attribute value across disconnected systems

Unfortunately, you don’t have unlimited time to figure this out. About half of CFOs have said that if an AI investment does not deliver measurable ROI within a year, it would be difficult to justify further investment.

That’s why starting with automation is so crucial. You need quick wins to maintain momentum and secure continued funding. Automation provides those wins: One survey respondent reported 12% productivity increases and 15% accuracy improvements when combining automation with AI.

Your 2026 investment strategy: Agentic business orchestration

AI has transformative potential, but that potential can only be realized when it’s built on a foundation of automation that provides:

- Standardized, repeatable processes

- Clean, reliable data

- Governance and compliance guardrails

- Measurable baselines for calculating ROI

- The infrastructure to scale beyond pilots

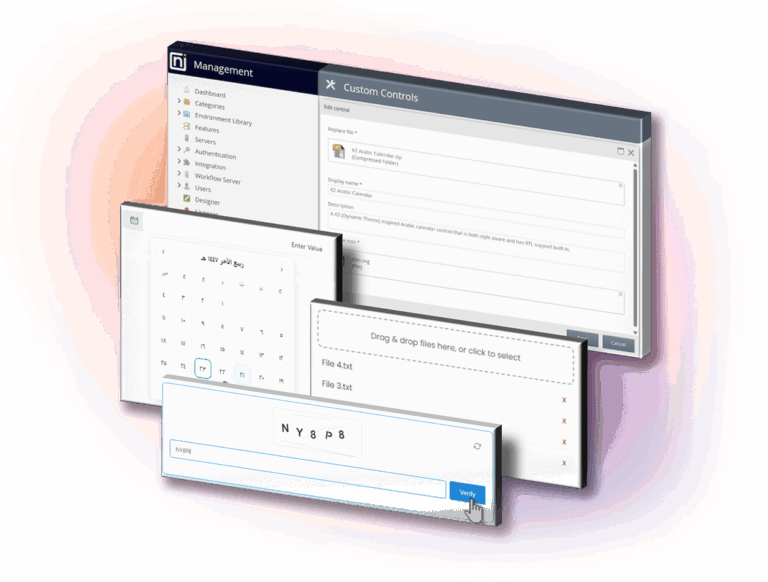

Organizations combining automation and AI report that 95% of their initiatives effectively deliver on business outcomes. Streamline your wins with an agentic business orchestration platform like Nintex.

Where automation alone once handled tasks, agentic business orchestration transforms execution itself. It unites process, systems, and AI agents into a single layer so work can flow directly into efficient outcomes for organizations, not into silos or more tabs.

As CFO, you’re responsible for ensuring technology investments deliver measurable financial value. The way to do that with AI isn’t to chase the latest models or rush into deployment: It’s to implement the automated infrastructure that allows AI to succeed.

Yes, the timeline for proving ROI is short and the pressure to demonstrate value is intense. But the path forward is clear: Automation first, AI second, measurable outcomes always.

Ready to build the automation foundation your AI initiatives need? Download our full report surveying 700+ CFOs and CIOs on unlocking business value from AI.