Loan Processing

Simplify and streamline loan processing with automated solutions

Capabilities Included:

Benefits

Happy customers

By quickly and accurately processing their loan application, you can ensure your customers are satisfied.

Free up employee time

When employees aren’t burdened with processing loans manually, they can focus on more demanding tasks.

Accurate data and robust data trail

Removing error-prone manual input and automating loan processing ensures better data and record keeping for audits.

Cut workloads by connecting your data and systems

Loan requests are submitted in a variety of ways, and they all need to go into your systems. But repetitive, time consuming and error-prone data entry creates bottlenecks in your loan processing workloads. With Nintex, information flows smoothly and automatically between all your systems, reducing input errors and fatigue, accelerating decisions, and optimizing loan processing center operations.

Connect your systems via workflows

Many of today’s digital banking systems have strong APIs that can easily be connected using workflows, allowing you to seamlessly and easily bring data and processes together to reduce the time and effort taken in loan processing.

Digitally Apply

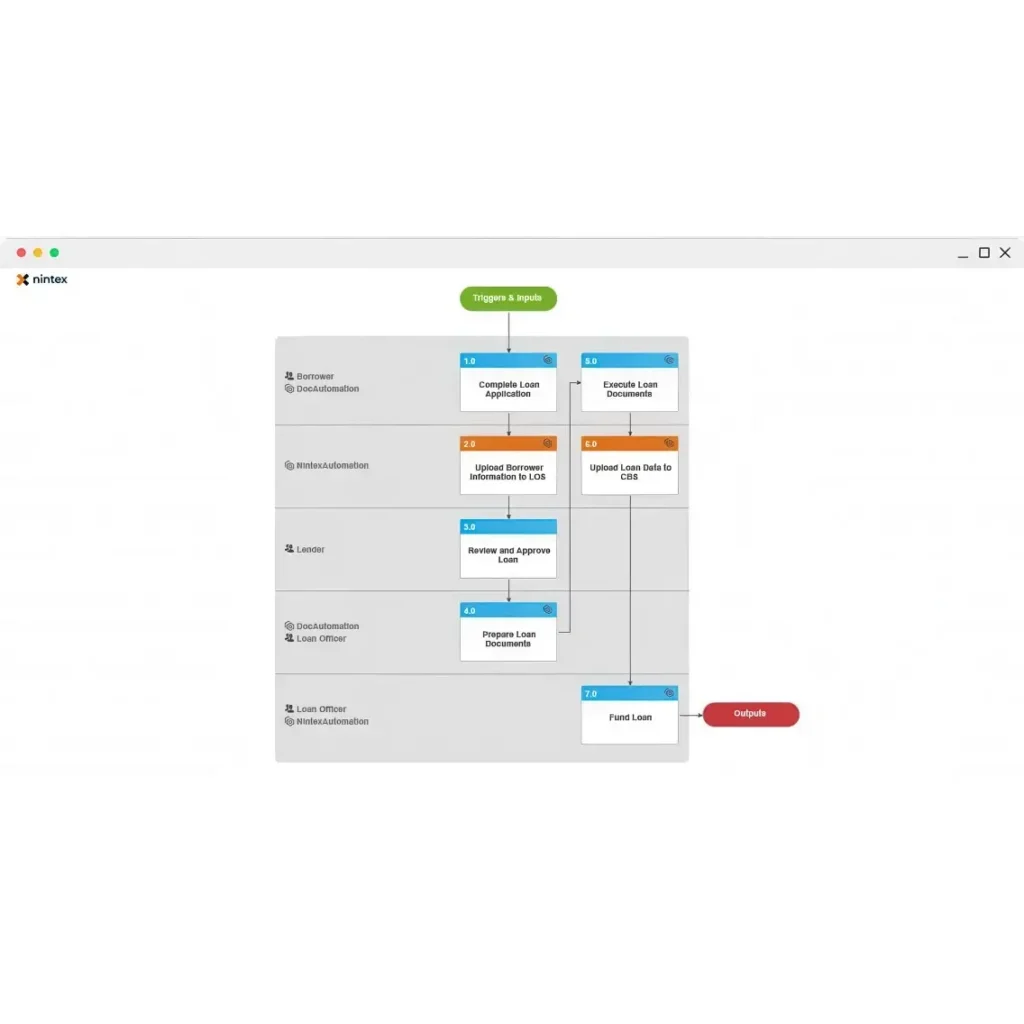

Expedite and automate loan processing from end to end

Loan candidates can now make their applications via simple digital forms. Their data is automatically uploaded into your systems. The application is then routed for review and approval, documents are autogenerated and sent to the applicant, and the loan is funded – quickly, simply, and smoothly.

Use RPA to connect your legacy systems

With older, legacy systems where you don’t have access to APIs, Nintex RPA can be used to automate loan processing and eliminate manual input bottlenecks.

Why Our Customers Trust Nintex on

Related Use Cases

Streamline, automate, and solve with Nintex

Explore related use cases showing how Nintex solves real-world business problems, from automating routine tasks to simplifying complex workflows.

Accounts receivable automation

Managing accounts receivable is one of the most important tasks a company has. Learn how Nintex Workflow and Intelligent Process Automation can help.

Invoice management

Invoice management systems that require manual input create bottlenecks in the process. Automate invoice processing to save time and money.

Contract management

Finalize contracts more easily, close deals quicker, and make more time for other business. See how Nintex can help with sales contract management.

Reduce operational risk

Manage risk, reduce costs, and increase productivity with the most powerful, easy-to-use platform for process automation and intelligence.

See for yourself

Put Nintex to the test

Because seeing is believing, let us give you a firsthand look at how Nintex can work for you.