At its heart, the Nintex Process Manager Risk Manager connects identified business risks with the core processes that they affect and makes that information visible and relevant to the people who need to see it.

Rather than relegating risk content to dusty manuals, it’s present within the process documentation in an easy-to-access and understand cloud platform that teams engage with on a daily basis.

With risks connected to business processes, users can see at a glance what the danger is in any step – what the organization could be exposed to should something go wrong – and act accordingly. It makes the risk visible and provides a way for risk managers to engage the relevant teams in conversation if change needs to happen.

When changes are made to relevant processes, nominated owners can be informed by email and in-app notification so they can address the potential changes and consider the implications of the update. Nominated employees that manage risk in their own respective areas can review the potential exposure before changes are implemented and discuss the ramifications with other stakeholders and the process authors.

Making risk visible

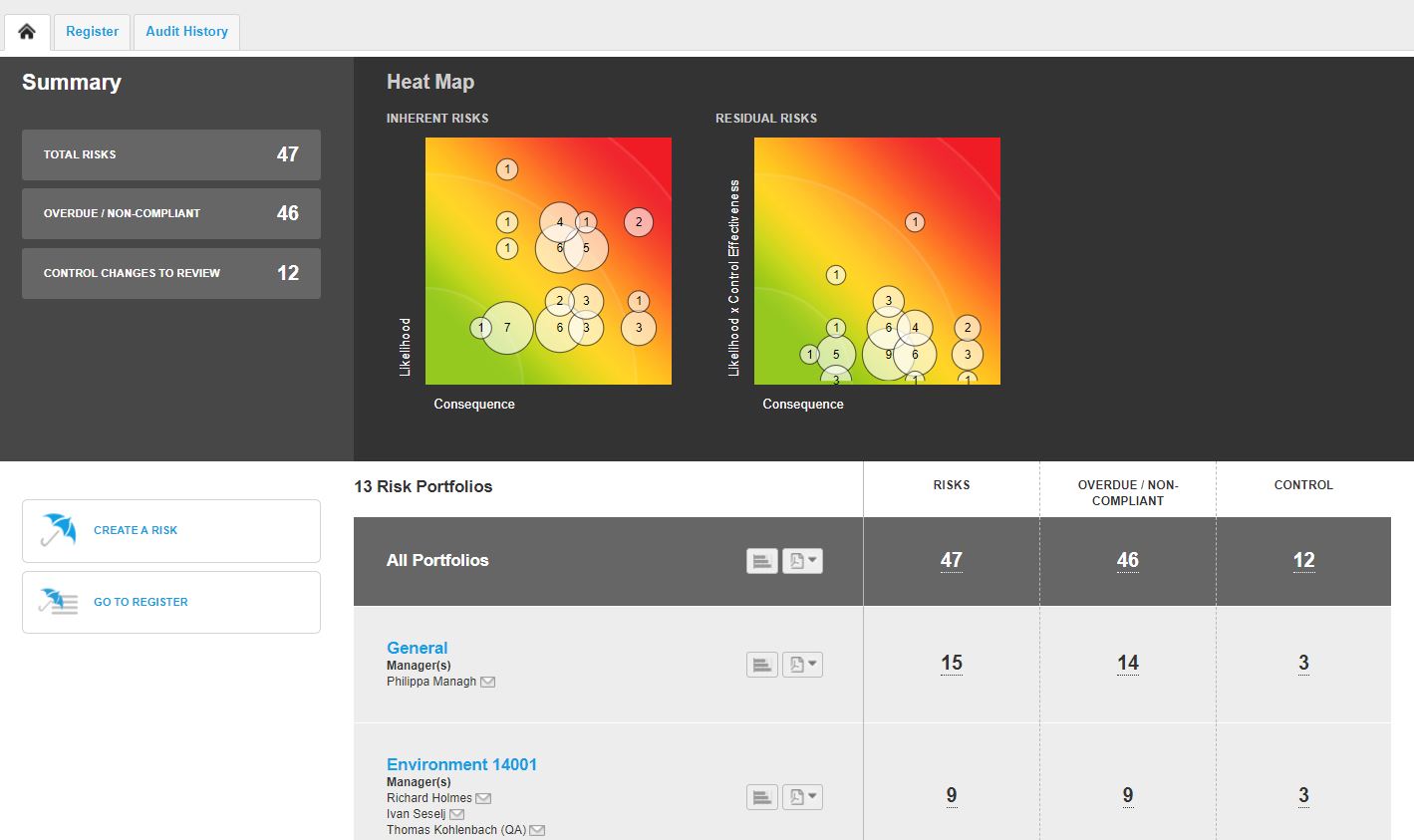

The Nintex Process Manager risk feature makes it easy to see and understand the organization’s risk exposure. The risk heat-map below shows at a glance where the existing risks sit in terms of severity and likelihood, and a modified view compares the same risks in their controlled state.

Each risk is assigned to a category, with classifications within those to clarify what specific circumstances the risk applies to. Risk portfolios like this can be set up to suit the shape and structure of your organization, with allocated owners assigned to each.

Within these portfolios, the risk rating criteria and scores are customizable too. That means the risk definitions are standardized across the business, but can still be customized within the portfolios. This flexibility ensures that a catastrophic risk in the manufacturing plant can be allocated a very different profile to a financial risk of the same magnitude.

By refining the categories and classifications, leaders can indicate where those risks are likely to have the greatest impact, and through those categories they have the flexibility to produce even more granular reporting on things like compliance, environmental risk, financial risk, or specific operations.

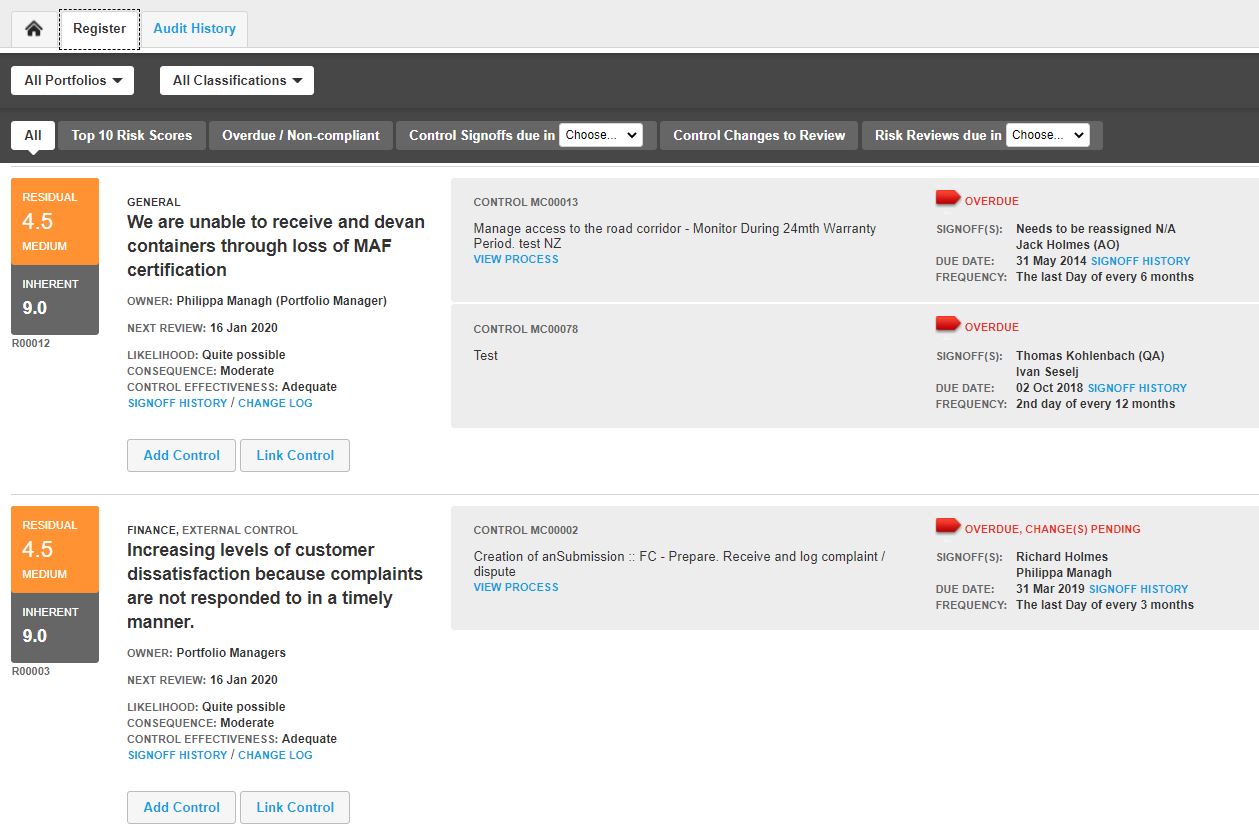

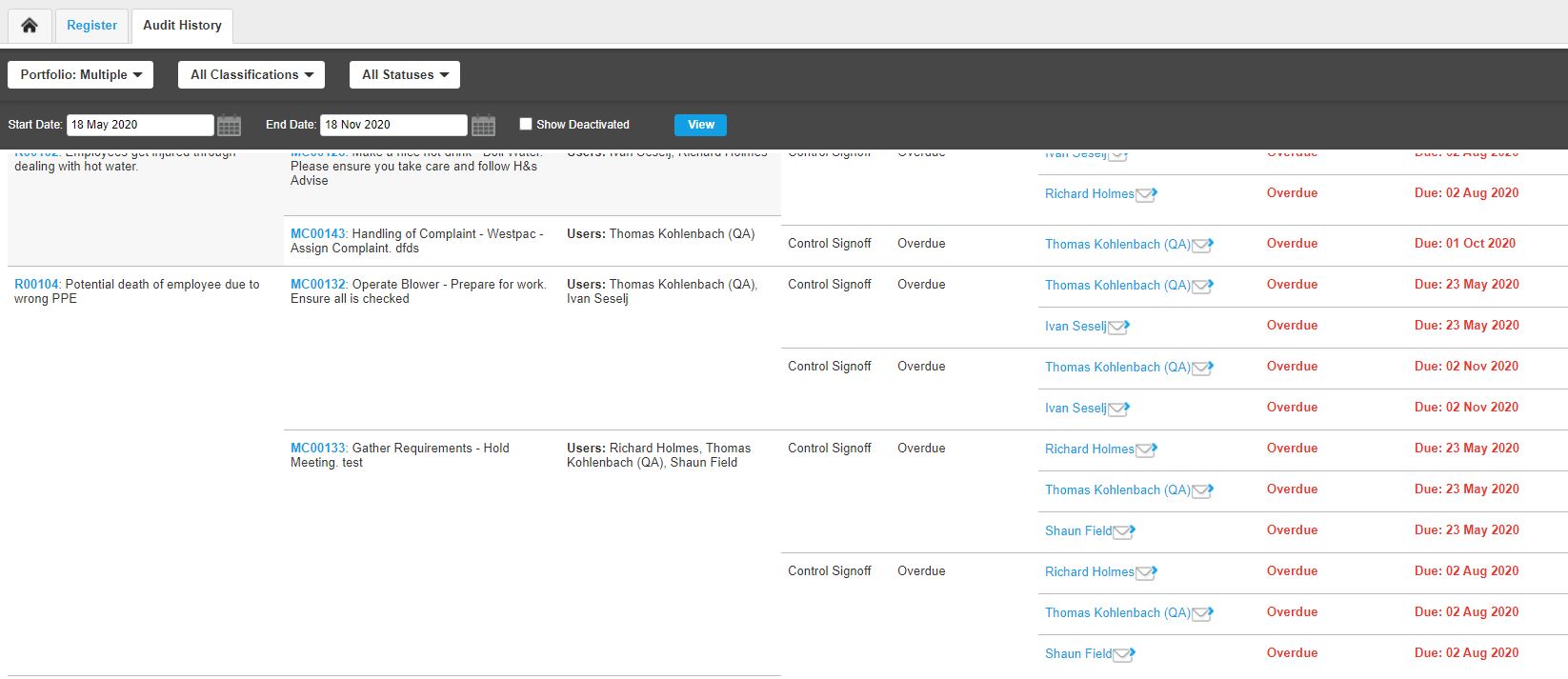

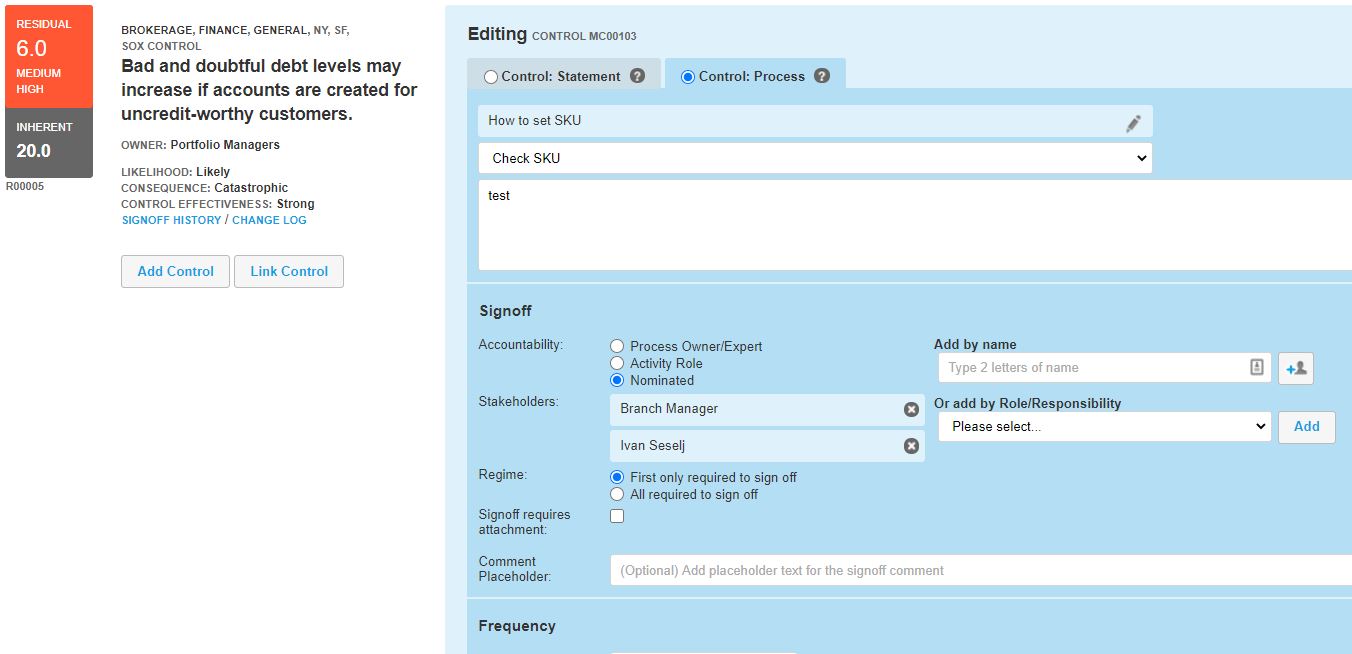

When controls are decided, they’re associated with specific risks, either as a statement of what has been done or through a process that implements the control. Stakeholders sign off that the controls are in place, and can be required to provide evidence such as images or documentation to support the signoff and provide a complete audit trail for compliance measures.

Where the controls aren’t being observed, the users can mark non-compliance, and flag action for the risk manager to investigate.

Where a control links to a process, that process can easily be accessed with just a click. The process indicates where the control comes into effect and why, with an easy-to-spot icon and pop-up information box.

The reference point also links back to the risk portfolio, meaning the information can be accessed from either end for a full picture of the risk and control relationship.

Manage risks with your processes

Understanding business risk is just the beginning of managing it. Having a robust platform that is user friendly and integrates effective risk management into your everyday processes is an essential step to ensure that what businesses recognize as hazards are identified, understood, avoided at every level and managed ongoing.

Automation of those processes can help you further manage and mitigate business risk, ensuring processes are completed the same way every time, with human errors minimized. A winning combination of process management and automation delivers effective risk management across the organization.

When risk managers, compliance experts, and front-line teams cooperate on proactive process driven risk management, it ensures that precautions are effective and both the operations and the enterprise itself are as secure as they can be and much less exposure to a compliance or regulation miss, failed audits, or even reputational damage occurring.

Establish total visibility, gain control, drive operational efficiencies, and manage risk with process management and automation. Download the eBook, Business risk is a process problem, to learn more.