Our Solutions

Find the perfect solution to power your organization

Whether exploring by department, challenge, or function, discover the industry-specific tool or use case-driven solution that’s just right for you.

Get started faster

Choose the Approach That Fits Your Business

Nintex gives you the flexibility to go from idea to outcome faster, whether you start with a ready-made solution or configure one to fit your exact needs.

Pre Built

Ready, proven solutions

Designed for common business challenges, these ready-to-go automation solutions let you quickly solve problems without starting from scratch. Perfect when you need speed, simplicity, and a customized approach for a technical challenge. Ready today for employee onboarding and license management.

Purpose built

Design for your specific needs

Generic tools slow you down. Solution Studio empowers your teams – business teams and IT partners – to create applications that align with your systems, workflows, and business logic. Create what your teams actually need to unlock more productivity and scale faster.

Meet Solution Studio

Deliver tailored solutions faster with repeatable components.

Most apps share the same DNA: dashboards, task lists, approval flows, portals. Solution Studio gives you these essentials as modular components so you can skip the blank slate and start building real solutions right away.

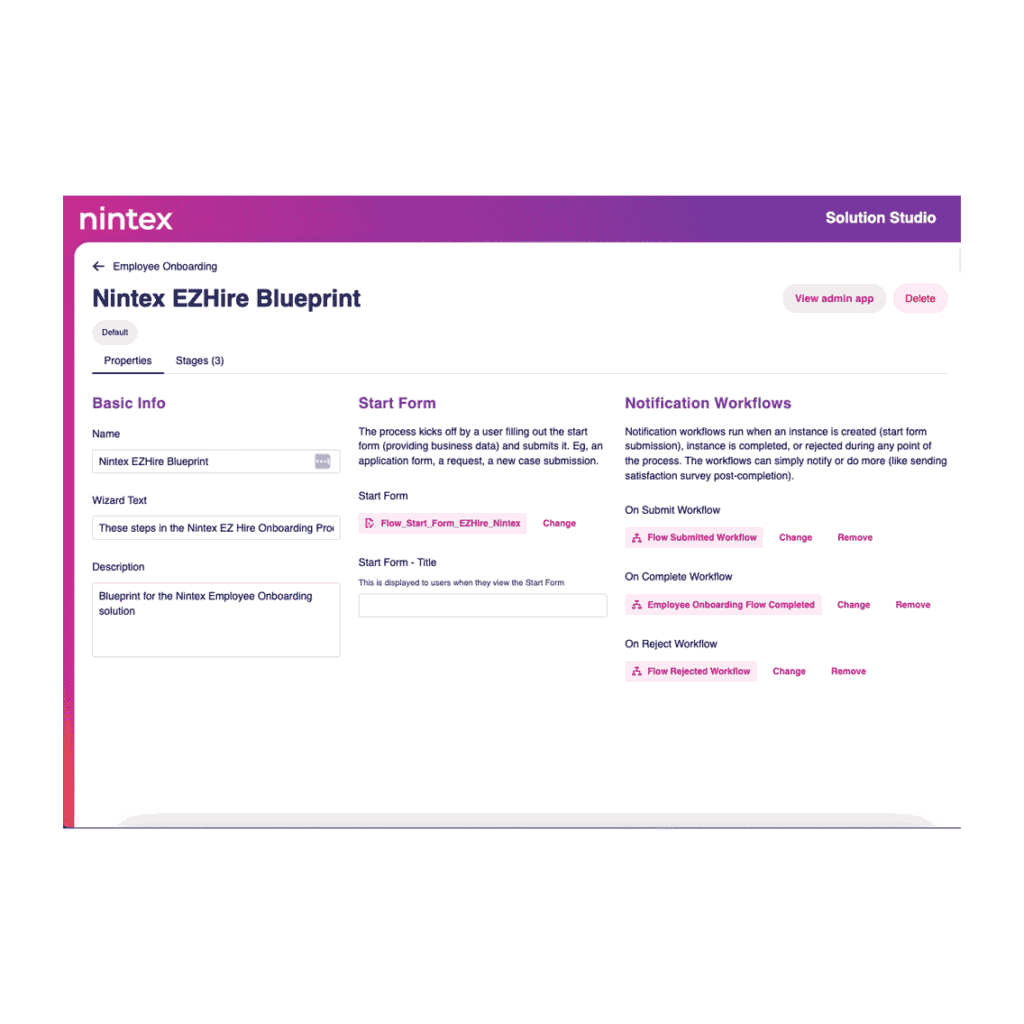

Company-specific workflows made easy

Solution Studio makes it easy to support company-specific processes by adding tailored, common steps like document generation, electronic signatures, and approvals. That means your team can spend less time managing workflows and more time driving results.

Reusable building blocks that save time

Create common modules like approval flows or document steps once, then apply them across teams, systems, and processes. With easy configuration, your team can move faster and minimize rebuilding logic or writing custom code.

Everything you need in one place

Design and launch full-stack solutions with built-in support for workflow automation, application development, and document generation capabilities. Equip your teams to move faster and work smarter by building within a single, easy-to-use portal that simplifies automation and scales with your needs.

Centralized control, simplified oversight

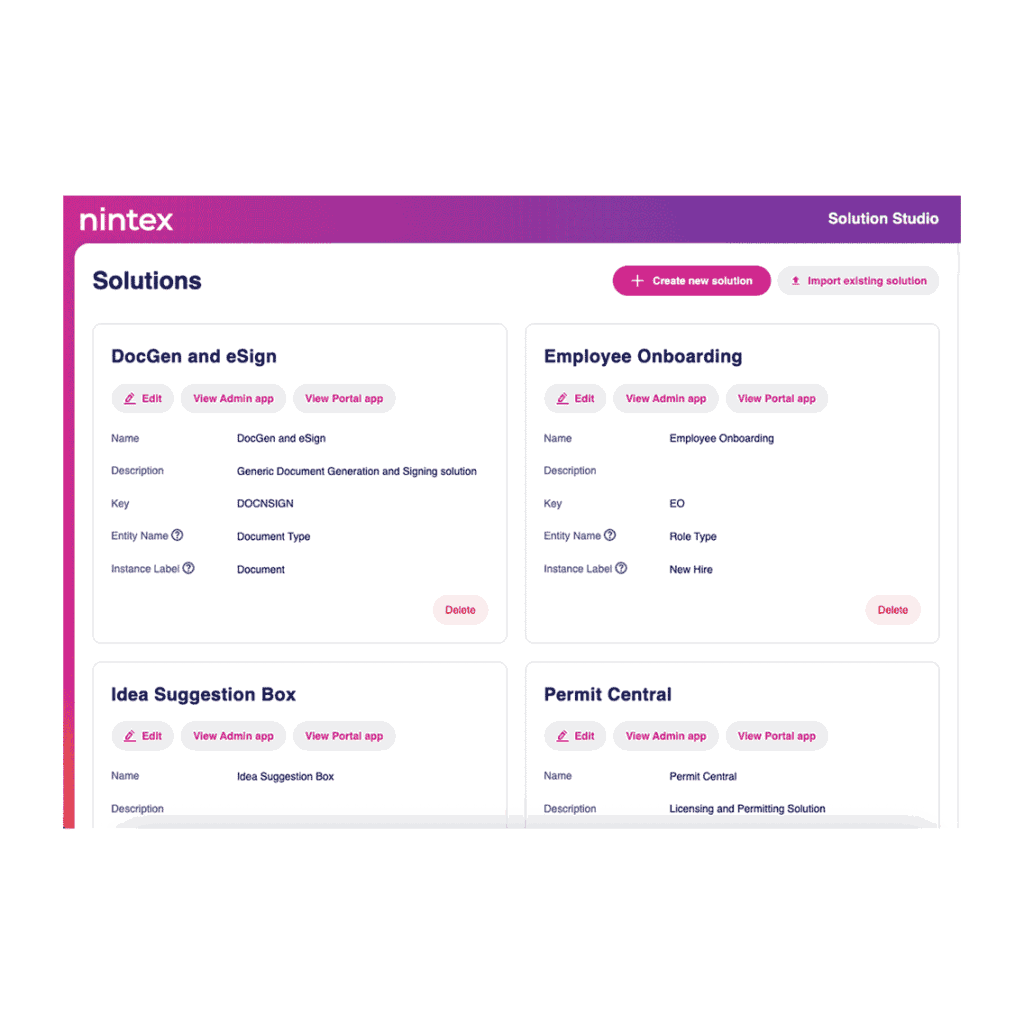

Use a core dashboard to view and manage the full set of drafted and deployed Solutions, allowing easy visibility into what’s been successful and can be reused, so automation projects scale and teams are efficient with their resources.

Edit, reuse, and launch workflows fast

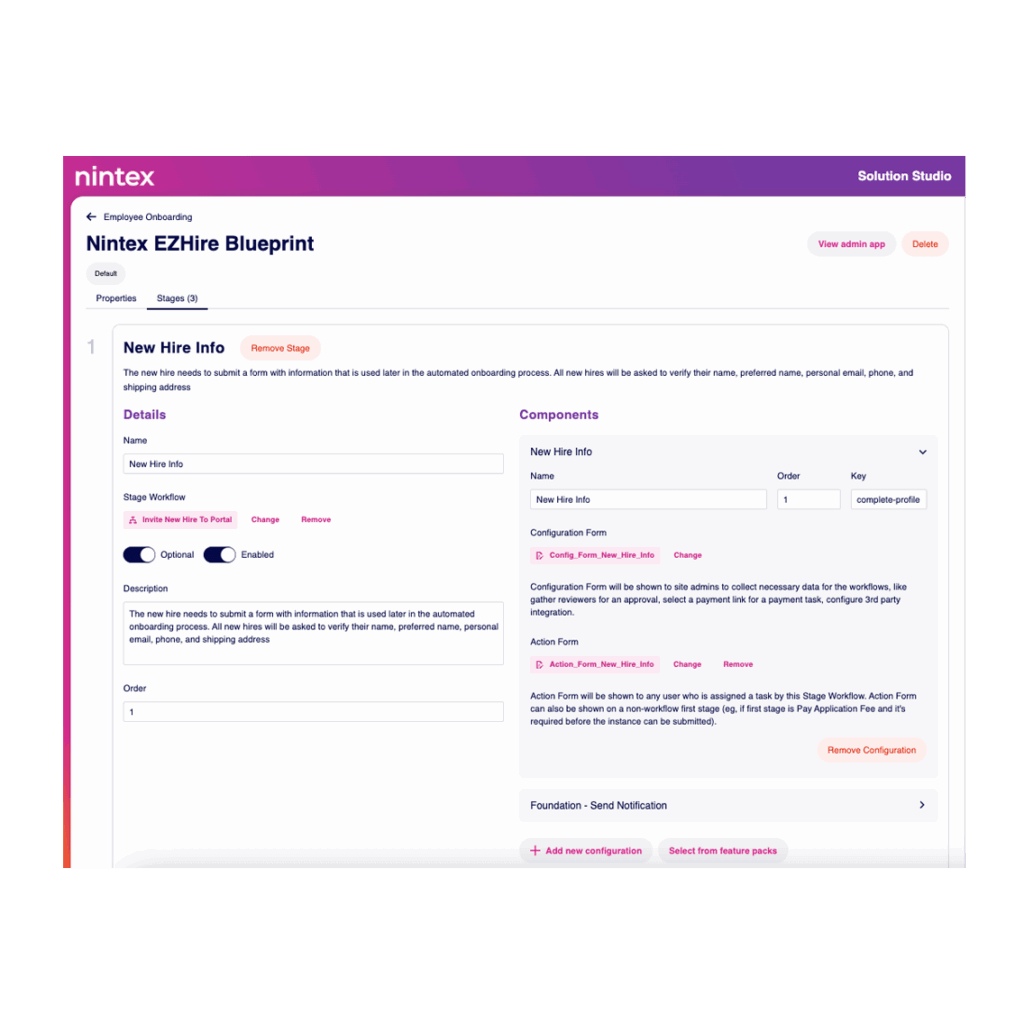

Built-in flexibility, including the ability to modify process steps, toggle actions, and clone existing workflows, helps teams rapidly build and roll out new automation. IT teams can rely on available templates or deeply customize the products, all from within the same portal.

Build smarter, faster: Automation without the overhead

Accelerate innovation with Nintex. Reusable feature packs, modular templates, and low-code tools empower teams to launch full-stack solutions—fast. Seamlessly integrate with your ecosystem, automate end-to-end processes, and adapt to unique customer needs without heavy dev lift. With rapid deployment and built-in scalability, you can prototype, customize, and go live in record time. Build boldly. Scale effortlessly.

Powerful capabilities to get you started

With an easy implementation process, Nintex Solution Studio empowers your team to quickly define the framework for a new application, including roles, approval steps, and document needs. This means you can get your app up faster and deliver results far more quickly, without needing to build a solution from the ground up.

Our use cases

See Nintex in action

Explore related use cases and see how Nintex Solution Studio can help you create apps faster and more flexibly.

Loan processing

With capabilities like forms, workflows, process mapping, and document generation, the Nintex Platform can help your bank streamline loan processing.

Discount approvals

Automate your discount approval process with Nintex

Hardware and software requests

Automate hardware and software requests process to alleviate burden on information technology department. Ensure your employees have everything they n…

Customer onboarding

Ensure seamless customer onboarding and deliver services as easily as possible.

Automate your human resources processes

See how core Nintex technologies make it easier to manage applications, approvals, and other complex workflows.

Nintex App Development

Use Nintex App Dev to create intuitive, powerful apps for managing licensing and permitting workflows – with minimal coding.

Nintex Document Generation

Easily create and distribute forms, contracts, and other documents in minutes using DocGen. Increase accuracy while decreasing manual work.

Nintex Workflow Automation

Use Nintex Workflow Automation create and integrate workflows that empower your teams, delight your customers, and save you valuable time and resources.

See for yourself

Put Nintex to the test

Because seeing is believing, let us give you a firsthand look at how Nintex can work for you.